7 Insider Tips for New Venture Capital Investors & Why Investing is a Lot Like Pro Surfing

Q & A with Venture Capital Veteran, Brian Smith, Managing Director at Grayhawk Capital

Q: How did you end up becoming a venture capital investor?

A: I had always planned on being an entrepreneur and starting my own company. During graduate school I had the unique opportunity of a summer internship with a venture capital firm called CID Equity Partners, based in Indianapolis. It was both challenging and exciting to work with multiple portfolio companies simultaneously while also looking at new investment opportunities.

I actually discovered that I loved the diversity of the work, so after graduate school I decided to move to Silicon Valley—the epicenter of the technology world—and pursue a career in venture capital. There I was fortunate enough to be hired on by Dominion Ventures, which kicked off a 26-year career in the VC world with three different firms.

Q: Did you ever re-consider your desire to be a venture capitalist?

A: When I first starting thinking about pursuing a long-term career in the VC world, an older partner at a small venture fund tried his best to dissuade me. His case was that some of the early semiconductor and software successes of the early 1980’s were an “aberration,” and that those kind of investment returns simply couldn’t be sustained.

Believe it or not, he thought the personal computer had created a one-time windfall for remarkable investment returns in companies like Microsoft, Apple, and Intel—and that those kind of opportunities wouldn’t happen again in our lifetime. Maybe he wasn’t the only one with that opinion, but my gut told me mankind will always innovate. Just look at history—innovation is actually a constant, and has only accelerated over the past century.

Fortunately my gut paid off. I’ve witnessed technological advances that are absolutely mind-blowing. In information technology, it’s been amazing to watch PC’s become connected through LANs, then WANs, and then the Internet.

Even more incredible—the evolution of technology now instantly delivered via mobile and wireless, making almost limitless information accessible from the palm of your hand. I don’t think anyone could have predicted exactly where we’d be today.

Thank goodness I ignored his well-intended, but seriously misguided, advice and pursued my VC career anyway. It’s been incredible to witness this period of astounding technological change that has transformed so much of our daily life.

Q: How has the venture capital market changed in the past three decades?

A: When I started working in venture capital in 1990, it was a relatively small cottage industry. At the time, annual money raised by the whole industry was only about $3 billion, and very few firms raised funds in excess of $100 million.

It was also an incredibly collegial community, with plenty of shared deals and co-investments. Back then, most venture funds just didn’t have adequate capital available to be the sole investors in companies, so they partnered up on deals.

In today’s market, though, there’s more than $50 billion in venture capital invested in companies annually and the size of many venture funds is in excess of $1 billion. That didn’t happen overnight, but now I look back and realize this small, cottage industry has turned into a massive global market of predominately institutional investors.

Although the deal flow certainly ebbs and flows, with so much technological innovation and huge market shifts in trends like mobile and social media, there’s no shortage of deals to fund. The game is finding the right companies, with the right technologies, pursuing attractive markets.

Q: What’s the biggest challenge for active investors in today’s economic environment?

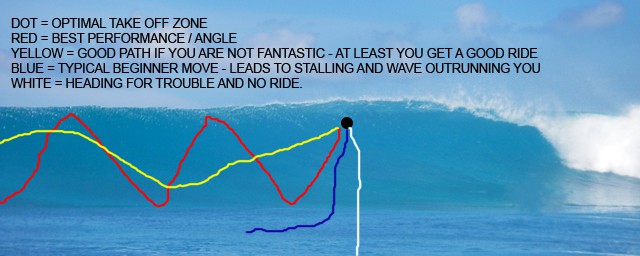

A: I guess you could think of investing like becoming a pro surfer. The waves are the technology and consumer trends that you’re trying to catch, and each ride is a different investment opportunity. With every one that comes in, you have to quickly assess if it’s the right one for you.

Sometimes you get beat up and knocked under the waves—a little bloody at times—but the thrill of catching the great ones gets addicting and keeps you paddling back out for more.

Naturally, with experience, you begin seeing common threads between winning waves and losing waves more and more often—what pro surfers call ‘ocean cues.’ You learn how to be increasingly selective about which waves you decide to paddle out for, but early on, it’s also easy to spend too much time on ones that aren’t worth the effort.

And sometimes, just like surfing, investment waves come in sets – a multitude of opportunities at the same time, all coming off of a few big trends that are shifting how the entire world operates. Hopefully you’ve honed your skills enough to be in tune with the ‘ocean cues,’ so you’re able to maximize such peaks to generate the most valuable and longest rides.

Surfing analogies aside, today’s active VC investor has to try to predict the direction of future technology and then bet on the companies that they believe have the best opportunity for success. With so much innovation and noise, frankly, that’s no small feat. We have to uncover the treasures in a sea of noise while trying to stay on the cutting edge of market demand. Too early in a niche and the wave falls flat… too late, and you miss the peak and it’s off to the competition.

With so much venture money out there these days, you could also argue there are too many funded startups in most new markets. That means overcrowding and fewer chances for success. It also means historically high company valuations.

The average valuation for similarly staged companies has doubled in just the last five years. That means it’s increasingly difficult to find reasonably priced deals. Ultimately, overfunding is bad for everyone. Sometimes startups just need to prove out their true value by selling first, and funding later.

Q: What do you think are the characteristics of a successful startup community?

A: I started at the center of the VC universe in Silicon Valley, and have lived and worked in two other regional markets so I’ve seen the difference between wildly successful startup communities and mediocre (or sometimes just immature) ones.

There seem to be four key things that separate the best communities from all others:

- An entrepreneurial ecosystem. It takes a village to foster a strong, thriving startup community… literally. You can

have entrepreneurs and startups, but without other key influencers giving back to the greater good of the community—investors, seasoned entrepreneurs, mentors, coaches, teachers and others—startup communities often fail to gain momentum.Rally those around you with a passion for giving and create organized movements designed to share ideas and advance the ecosystem collectively. - Capital available for investments. The best startups that ultimately go unfunded for whatever reason are like jetliners without fuel; they sit on the runway, maybe inching along and growing very slowly, if at all. Without the necessary jet fuel—they never get the opportunity to really take flight and hit the altitudes they deserve.Marketing even small successes to pockets of investors in regional communities often gives a community

the visibility it needs to bring in the investment fuel and put a startup community on the map. - Outstanding existing technology companies. If a person tends to become the average of the five people they spend the most time with, then it stands to reason that startup success and innovation seems to breed more innovation and success… and that’s exactly what I’ve seen.There’s something about the collective power of a few good ones inspiring other entrepreneurs to take the risk. More mentors and more role models breeds more success too, so start by focusing on a few, making them great, then parlaying that success network into others.

- A public environment that supports the startup community. The best startup communities have a number of formerly successful companies that have spawned many other startups, and who’s leaders understand the deeper meaning of pouring their own learning and value back into others. Managers should be focused on developing the next great technologies and starting their next ventures on the heels of their own successful exits.For all of that to happen, venture capital and angel capital needs to be readily available, and the community needs to attract and retain the kind of talent needed sustain startups as well as the broader ecosystem.Engaging the public service environment via city, state and university networks also generates momentum, talent and resources such as research dollars. Fighting for proactive, startup friendly legislation, and using public pension funds to support local venture funds and other institutional capital can also have a tremendous long-term benefit on the success of local ecosystems.

So far, the VC world has been an amazing ride. Thank goodness I couldn’t be dissuaded years ago. It’s remarkable to be a part of the startup journey, and to see the kind of collaboration and innovation that is changing the world on local, national and in many cases, global scale.

It’s an exciting time to get engaged, so I encourage anyone considering taking the leap to connect with other investors at local events to help shape your decision process.